GUIDE: How to Build Generational Wealth

Building Generational Wealth: A Legacy of Love

At F5 Financial, we’re proud to work with clients who see their money not just as a means to grow richer, but as a tool to shape lives—now and long into the future. These are people with vision. People who set goals that reach beyond their own lifetime. One of the most meaningful goals we hear again and again? “I want to leave a legacy.”

That legacy is often defined by something more than numbers on a balance sheet. It’s about building generational wealth—resources that don’t just support your own needs, but help lift up your children, grandchildren, and even your community for years to come.

What Is Generational Wealth, Really?

At its core, generational wealth means creating and preserving wealth that lasts. It’s not a quick win or a flash-in-the-pan investment—it’s a long game rooted in strategy, stewardship, and heart.

Generational wealth can take many forms:

-

A thriving investment portfolio

-

Real estate that appreciates over time

-

Business ownership

-

A meaningful inheritance

-

A trust, education fund, or philanthropic endowment

But the defining feature? This wealth continues to grow and serve others, well beyond your lifetime.

Why Generational Wealth Matters

Nick Murray, a respected voice in the world of financial planning, once offered a powerful question to ask during client discovery:

“What do you most hope will happen financially over the balance of your lives—and what do you most fear?”

This question reveals a lot. It cuts through the clutter of status and short-term thinking. Because generational wealth isn’t about beating the market or owning a bigger boat than your neighbor. It’s not driven by ego.

It’s driven by love.

Love for your family. Love for your values. Love for your community. And a desire to ensure that your success becomes a stepping stone—not a finish line—for those who come after you.

A Guide to Building Generational Wealth

If the idea of leaving a lasting legacy resonates with you, the next step is putting a plan into motion. In our full guide, we’ll walk you through:

-

The core financial principles that protect and grow wealth

-

Visual tools to help structure your legacy plan

-

Action steps to make your vision a reality

It’s never too early—or too late—to start building wealth that lasts. And it begins by asking: What do I want my money to say about me when I’m gone?

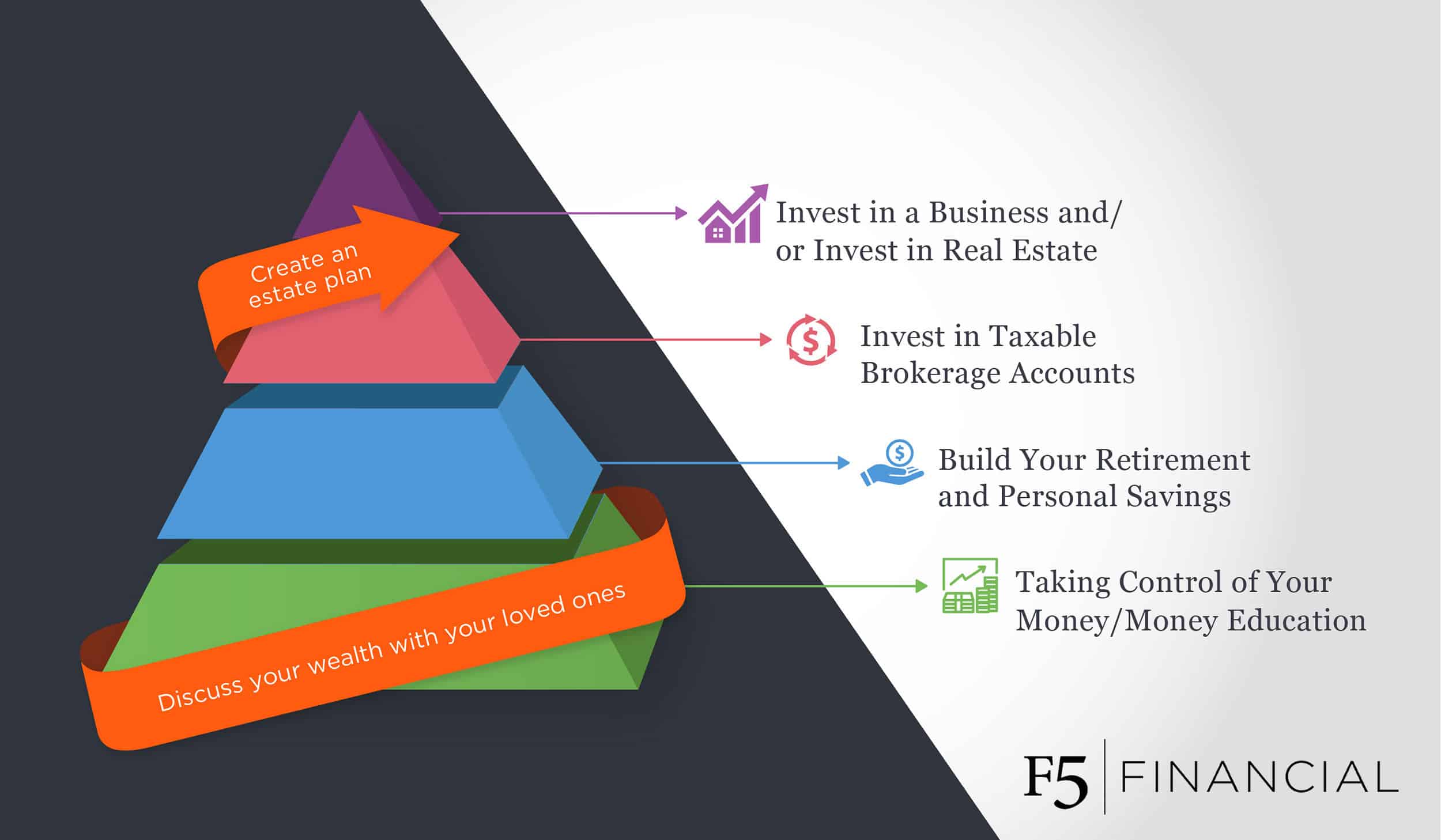

Steps for Building Generational Wealth

If you know generational wealth is important to you, here are my recommended steps and actions for building it.

- Take Control of Your Money Instead of Letting Your Money Control You

Step 1 is the foundation for building generational wealth.

In Dr. Thomas J. Stanley’s best-selling book, Stop Acting Rich…And Start Living Like a Real Millionaire, he talks about the three types of wealthy people: The Glittering Rich, the Wealthy Affluent, and the Balance Sheet Rich.

It’s this third type – the Balance Sheet Rich – that you should aspire to be if you want to build generational wealth.

The Balance Sheet Rich have their wealth on paper. They don’t display their wealth by purchasing expensive things (like the Glittering Rich), and they don’t spend more than they make, leaving them with an empty bank account despite their high income (like the Wealthy Affluent). They understand their income, make a budget, then make smart choices about how to use their money.

The Balance Sheet Rich have full control of their money, and that is how they build generational wealth. To develop this kind of control, you need to be educated on money management; whether it be from a financial planning book, a class, or by speaking with a financial advisor, you need to be informed about the power your money offers if it’s managed in the right way. So, to take control of your money, you need to seek out ways to be educated about money management.

- Build Your Retirement and Personal Savings

Once you have a firm grasp and understanding of your income and budget, the next level toward generational wealth is saving—saving for retirement and building personal savings that can be used in case of emergency. Saving for retirement and emergencies doesn’t sound sexy, but it is a necessary next step to generational wealth—if you do not have the funds to buoy yourself, you’ll have no chance of building wealth to help others.

There are many ways to save for retirement, like through an employer-sponsored 401k or by establishing a Roth IRA. As for your emergency fund, a good rule of thumb is that you save six months’ worth of living expenses.

- Invest in Taxable Brokerage Accounts

After you’ve built a decent nest egg and emergency fund, you should begin investing in taxable brokerage accounts, where you can use extra income to invest in the stock market and mutual funds. This strategy has a low barrier to entry – all you need is a no-fee online brokerage account and a little bit of money to start investing – and the stock market has a great track record if you invest for the long-term. If you decide to do self-directed investing, for best results you should set up automatic investments, where money automatically withdraws from your bank account and invests in the indices or funds you’ve chosen.

- Invest in a Business and/or Invest in Real Estate

Now that you have your retirement and emergency savings built up and you have cash in the stock market, it’s time to diversify extra money by investing in a business or real estate.

If you have a passion for starting a business, creating a vehicle for earning money is a great way to pass wealth to the next generation. If you don’t have a passion to build your own business, you can still diversify by investing in someone else’s business, provided it has a proven track record and you’ve done your research to ensure it’s on a healthy footing.

You can also invest in real estate. Real estate is fairly reliable in its potential for value growth and can provide steady cash flows over time. If purchasing real estate for the purpose of leasing it doesn’t appeal to you, you can consider buying a real estate investment trust, or REIT, which is like buying stock in property (instead of owning it completely).

These four steps, in this order, are a great pathway to building generational wealth. But generational wealth is only generational if it outlasts your lifetime. To ensure that your wealth will provide for your heirs and beyond, you need to take steps to preserve it.

How to Preserve Generational Wealth

- Create an Estate Plan

We have a saying at F5 Financial: “We believe that your family or community organizations will put your money to better use than the government.”

What we mean by this is, if you don’t make a plan for what will happen to your money after you’re gone, it will likely be taxed at a higher rate than necessary. There are various ways to reduce your estate’s tax burden – whether it be through tax planning or donor-advised funds – that will ensure more money gets into the hands of the people you want to have it, and not Uncle Sam.

Your estate plan also needs to address how you want your wealth passed on. You know your heirs best, and you may need to make tough decisions about who gets control over your assets if you want to make sure their full value is reached after you’re gone.

- Discuss Your Wealth with Your Loved Ones

To ensure the wealth you have built continues to build for generations to come, it’s important to discuss your wishes with the people set to inherit it. Just like you took the time to educate yourself about money, it’s important for your children, and your grandchildren, to do the same. When they have an understanding of the power of a well-managed portfolio, talk to them about your family’s wealth, how to grow it for the long-term, and why it should be protected and nurtured beyond your lifetime and throughout theirs.

If you are interested in speaking with a fee-only financial advisor about building generational wealth, please contact F5 Financial or book a call with me.