Factor-Based Investing – The Equity Premium

Decades of academic research have identified that there are systematic differences in expected returns based on what is commonly referred to as factors. We can exploit these factors to structure portfolios to target higher expected returns. An example is the equity premium.

Persistent and Pervasive Factors

While there is no guarantee that these factors will continue to out-perform over time, empirical evidence has suggested that these factors have been persistent (i.e., occurred over time) and pervasive (i.e., occurred over the equity markets in various geographical regions).

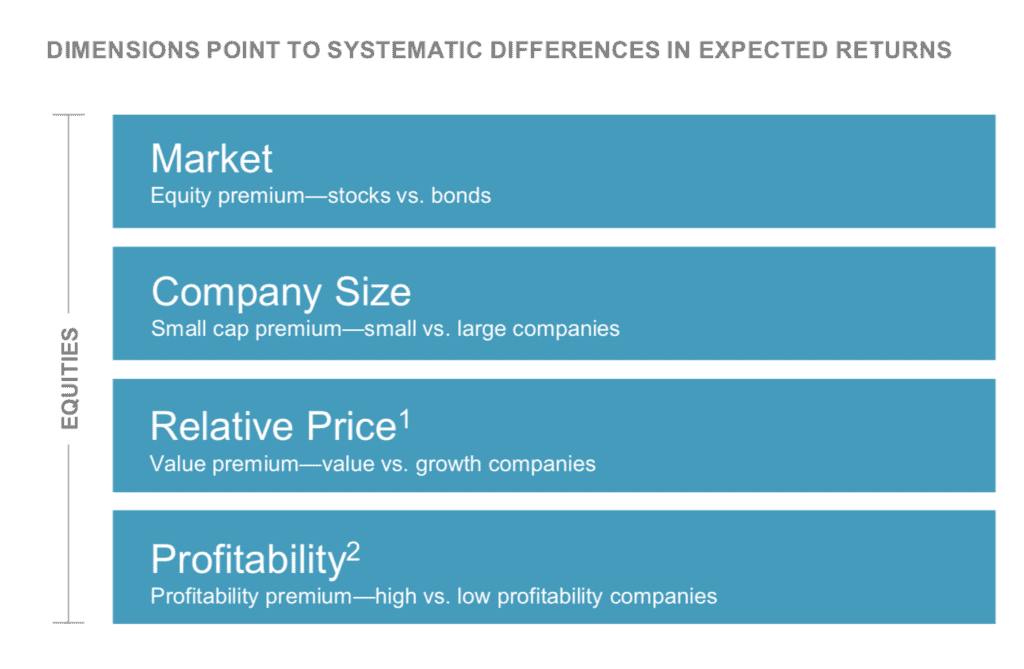

4 “Premiums” of Return

Over the next several weeks, we are going to discuss the four factors that have been shown to be persistent and pervasive. These factors give rise to “premiums” of return. These premiums are:

- Equity premium

- Small cap premium

- Value premium

- Profitability premium

5 qualities

To be considered a dimension of expected return, a premium must be all of the following:

- Sensible

- Persistent

- Pervasive

- Robust

- Cost-effective

This week: The Equity Premium

This week we are going to take on the equity premium. The equity premium is based on empirical evidence (i.e., data) that suggests stocks will outperform bonds.

No doubt, more than a few people reading this will be thinking “duh!” That’s OK. That the premiums are intuitive is one of the best things about them! In my opinion, the most amazing research in the world is often NOT valuable unless it is backed up by intuition—the proverbial sniff test, if you will.

The equity premium - an extra “reward”

To go into it a bit deeper, the equity premium suggests that there is an extra “reward” that is provided to those who OWN companies (i.e., stocks) versus what is provided to those who LOAN to companies (i.e., bonds).

Essentially this says that if you want to see higher expected returns in your portfolio, you need to include a higher percentage of stocks versus bonds. This approach is fundamental and well-established in building and designing portfolios.

In upcoming weeks, the other 3 premiums

In the following weeks, we will go through the small cap, value, and profitability premiums. Each of these premiums will also have a logical, easy to understand explanation that backs up what the academics have found. For this reason, I have a high degree of confidence in using a factor- based approach to investing, which is built on leveraging these premiums.

You can also “read ahead” by jumping to this link which contains a PDF file going into more detail on this topic.

Would You Like More Support?

- Do you have a well-defined Investment Policy Strategy that is used to drive your investments in support of a comprehensive financial plan?

- If not, would you like to partner with someone who is used to helping people get through these struggles and (then, with confidence) implement portfolio strategies in a systematic manner while focusing on your desired outcomes?

If so, feel free to send us an email or give us a call. We’d love to have the opportunity to help you find a bit more peace of mind when it comes to investing.

F5 Financial

F5 Financial is a fee-only wealth management firm with a holistic approach to financial planning, personal goals, and behavioral change. Through our F5 Process, we provide insight and tailored strategies that inspire and equip our clients to enjoy a life of significance and financial freedom.

F5 Financial provides fee-only financial planning services to Naperville, Plainfield, Bolingbrook, Aurora, Oswego, Geneva, St. Charles, Wheaton, Glen Ellyn, Lisle, Chicago and the surrounding communities; to McDonough, Henry County, Fayette County, Atlanta and the surrounding communities; to Venice, Sarasota, Fort Myers, Port Charlotte, Cape Coral, Osprey, North Port, and the surrounding communities; and nationally.

We'd love to have the opportunity to hear about your situation. Contact us here to schedule an appointment for a consultation.

Learn more about What We Do.

Helping You With

Wealth Preservation – Wealth Enhancement – Wealth Transfer – Wealth Protection – Charitable Giving