Posts Tagged ‘long-term investing’

Leadership Lesson 20 – Eat!

Is there anyone out there who does not enjoy Thanksgiving dinner? How about the Fourth of July BBQ? Or the office potluck where everyone brings copious amounts of food?

Read MoreLeadership Lesson 19 – Your People Are the Priority

With the pace of business these days, it’s easy to get caught up in pursuing the next project, the next objective, the next dollar. It’s also extremely dangerous to fall into this trap and lose sight of what is really important . . .

Read MoreLeadership Lesson 18 – Playing Nice with Others

I have learned a ton of things over my time in the workplace. Perhaps no lesson was more transformational than the importance of “soft skills” versus “hard skills.”

Read MoreLeadership Lesson 17 – You’re Not Davy Crockett

American folklore loves to celebrate the rugged individual that blazed trails for all to follow. Daniel Boone, Davy Crockett, the young Abraham Lincoln. All these big, rugged, self-sufficient men took on the world single handedly and prevailed. Poppycock!

Read MoreLeadership Lesson 16 – The Feedback Loop

To succeed long-term, you and your team must have alignment of goals and efforts. And the only way to ensure alignment is to review the goals and efforts!

Read MoreLeadership Lesson 15 – Never Compromise

So you’ve built the best team in the world, given them all of the tools, provided a great environment, and let them know you care. You’re done right? WRONG!

Read MoreLeadership Lesson 14 – It’s About the Money

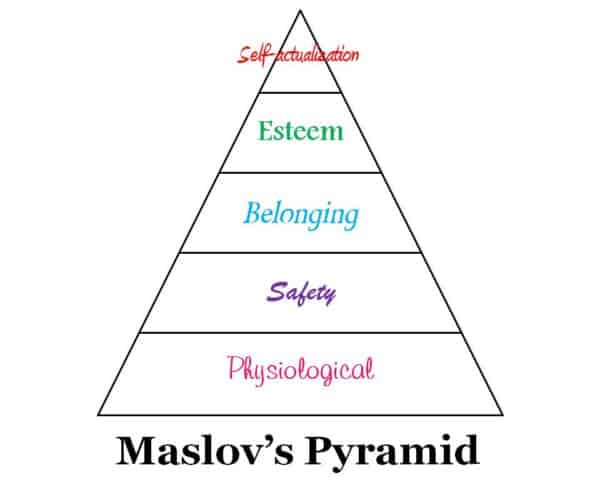

The key here is that the statement is “importance of money” and not “importance of more money.” Going back to Maslow’s hierarchy of needs, the 2 base layers include food and home—both of which require money.

Read MoreLeadership Lesson 12 – You Are a Role Model

In spite of what Charles Barkley may claim, leaders are role models. You’re going to be out in front of folks. You’re going to be up on the “big stage.” And people are going to be watching.

Read MoreLeadership Lesson 10 – Take One For Your Team

Rule #10: Take responsibility for your team’s shortcomings and failures.

Read MoreLeadership Lesson 5 – Quit Hoarding Information!

We’ve all heard it before: knowledge is power. Unfortunately, too many leaders let their fear of losing control dominate their behaviors and, accordingly, hoard the vast majority of all of the information they obtain.

Read More