Financial Freedom Tips (VIDEO) – 5 Keys to Creating Smart Goals

By: Josh Duncan

How do I create smart goals?

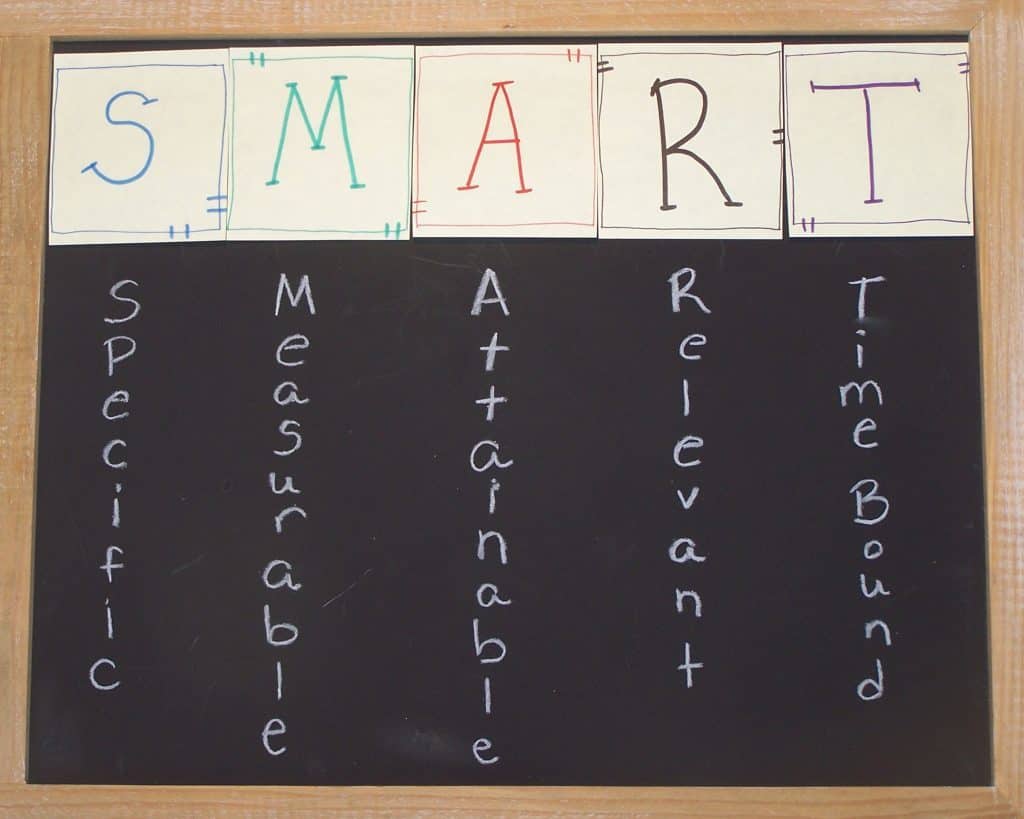

In this 3-minute video, I'll share the 5 keys to creating S.M.A.R.T. goals. When your goals are specific, measurable, achievable, relevant, and time-bound, they propel you forward. Smart goals will lead you toward personal significance. (Full Transcript is below.)

Full Transcript of video

Hello, I’m Josh Duncan with SCBTV News bringing you this edition of Financial Freedom. The purpose of Financial Freedom is to provide tips to help you achieve financial freedom for personal significance.

Welcome to the third episode in our series about goals and how they can help you achieve personal significance. Last time we discussed the tension between the ease of setting a goal and the complexity of meeting the goal. Today we are going to discuss making goals SMART.

I remember learning about SMART goals when I began my first corporate position at Caterpillar after college. Fresh out of school with no real corporate experience and I was directed to document my goals for my first year in “the real world.” This felt like an impossible assignment as I was still learning my role as an entry level programmer. Thankfully, a more tenured coworker helped me through the process.

Now that I’ve had 16 years to practice writing SMART goals, I’ve learned a few things that have made this a less strenuous event for me. Let’s review what the SMART acronym means and then discuss a few tips to help you with your goals.

SMART stands for specific, measurable, achievable, relevant and time-constrained. Making your goal specific is straight forward. The idea here is to make your goals as clear-cut as necessary for you, your team and your manager. This will help keep everyone involved on the same page.

Making your goal measurable is simply stating how you will know when you have achieved your goal. For example, if your goal is to start saving for retirement, your goal should state the amount of money you plan to have saved by the end of the year.

Next is ensuring your goal is achievable. This is where you can identify what additional skills, support and resources you may need to accomplish your goal. You want to stretch yourself but not make an insurmountable hurdle.

Your goal must be relevant to the greater good your goal supports. If your goal is for your business, then the completion of the goal should move the business forward. Conversely, a personal goal should move you closer to your personal mission.

Finally, your goal should have a time constraint for when it should be completed. Without a set time to complete the goal, it likely will not be completed.

Now that you know the attributes of SMART goals, let me share some tips to help you move forward. First, documenting your goals requires intentionality. It will be easier to head to lunch with your coworker or friend than to take an hour to write out your goals. Schedule the time on your calendar and get started.

Next, keep your list of goals to seven or less. If this is your first time documenting your goals, then start with two to three goals. Remember, you want realistic goals. Start with a shorter list and add more if you complete your first set of goals.

Finally, ask for help. Find a friend who you can share your goals with and ask them if they will help hold you accountable. It’s great to have a friend checking in with you as they value you and your relationship. They want to help you get where you’re going.

As we wrap up on SMART goals, remember why you are setting your goals. Making your goals SMART is the first step in acting on your goals. Next time we will discuss tracking your goals.

Thank you for joining me for Financial Freedom. I'm Josh Duncan with F5 Financial Planning, helping you achieve financial freedom for personal significance. Please send topics you would like me to cover to me at this link. See you next time.

Most recent video blog post:

Financial Freedom Tips - 3 Steps to Accomplish Any Goal

F5 Financial

F5 Financial is a fee-only wealth management firm with a holistic approach to financial planning, personal goals, and behavioral change. Through our F5 Process, we provide insight and tailored strategies that inspire and equip our clients to enjoy a life of significance and financial freedom.

F5 Financial provides fee-only financial planning services to Naperville, Plainfield, Bolingbrook, Aurora, Oswego, Geneva, St. Charles, Wheaton, Glen Ellyn, Lisle, Chicago and the surrounding communities; to McDonough, Henry County, Fayette County, Atlanta and the surrounding communities; to Venice, Sarasota, Fort Myers, Port Charlotte, Cape Coral, Osprey, North Port, and the surrounding communities; and nationally.

We'd love to have the opportunity to hear about your situation. Contact us here to schedule an appointment for a consultation.

Learn more about What We Do.

Helping You With

Wealth Preservation – Wealth Enhancement – Wealth Transfer – Wealth Protection – Charitable Giving