Why Market Timing is NOT a Good Idea

By: Curt Stowers

What is Market Timing?

The sirens sing out—buy low and sell high! And many, many are tempted to believe that they can successfully pull off market timing. On the surface, it is easy:

- Watch the market and determine when stocks are “too high” and sell.

- Watch the market and determine when we have “hit a bottom” and buy.

“All” you have to do is successfully complete these two steps.

However, there is no record of anyone successfully accomplishing these two tasks repeatedly over time.

What is the Cost of Market Timing?

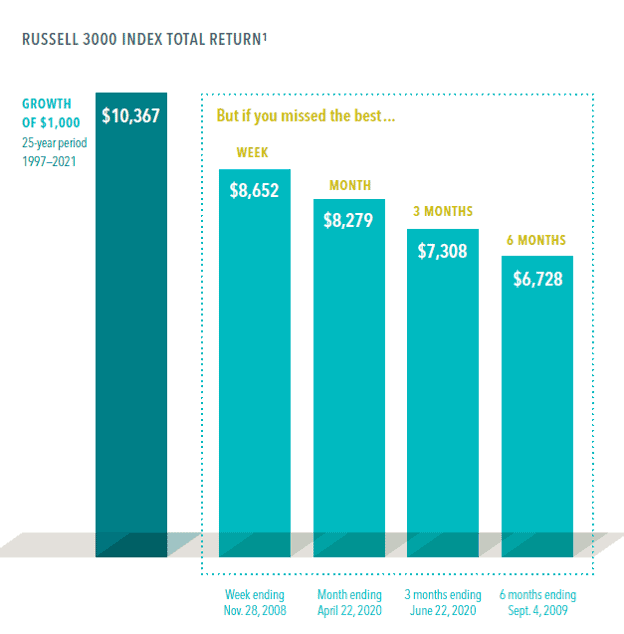

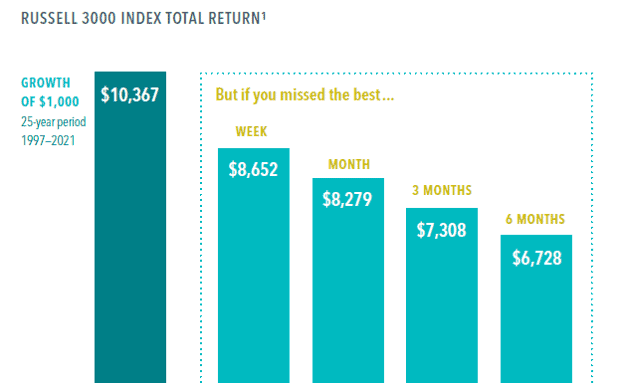

If you COULD successfully pull off market timing, it would be awesome. However, as I stated above, it’s not something that has been accomplished systematically. That begs the question, “What if I do it wrong?” The attached table highlights the cost of doing things “wrong”:

- The impact of being out of the market for a short time can be profound, as shown by this hypothetical investment in the stocks that make up the Russell 3000 Index, a broad US stock market benchmark. Staying invested and focused on the long-term helps to ensure that you’re in the position to capture what the market has to offer.

- A hypothetical $1,000 investment made in 1997 turns into $10,367 for the 25-year period ending December 31, 2021.

- Over that 25-year period, miss the Russell 3000’s best week, which ended November 28, 2008, and the value shrinks to $8,652. Miss the best three months, which ended June 22, 2020, and the total return falls to $7,308.

- There’s no proven way to time the market—targeting the best days or moving to the sidelines to avoid the worst—so the evidence suggests staying put through good times and bad.

Missing only a brief period of strong returns can drastically impact overall performance!

Why is this so Alluring?

I’ve often wondered this: If there is no track record of success AND the cost is extremely high in trying and failing, why is this concept so alluring?

I don’t have the studies/research to back it up; however, my thoughts are as follows:

- The simplicity of “only” needing to make two “easy” decisions tempts people to try. Furthermore, a single successful decision reinforces the idea that “I can do it” and lures people in to try again. The simplicity is hard to resist.

- When the market is at its most volatile, people want to “do something.” Buying or selling “feels” like you are doing something. What people miss out on is that sticking with a long-term strategy is ALSO “doing something” AND it has a much better track record!

Sticking with a long-term strategy is ALSO “doing something,”

AND it has a much better track record!

These two things (“I can do it” and “I have to do something”) are—in my opinion—two of the biggest drivers behind this dangerous approach.

Still considering trying market timing? Do this first!

Please, please, please think long and hard before you go down this approach. Do the research, talk to others, and get “proof” from anyone who claims they know how to time the market.

I would STRONGLY recommend that you ask anyone taking this approach if they are “all in” with their dollars. Furthermore, ask them if they are “doubling down” with leverage given their supreme confidence. You may find someone who is that committed; however, in all likelihood, you’ll find someone who is happy to provide you guidance on what YOU should do while they sit by on the sidelines.

Hopefully, this quick tour through the concept of market timing has provided you with a bit more perspective on the concept. If you have more questions, I’m always available to discuss.

Would You Like More Support?

- Do you have a well-defined Investment Policy Strategy that is used to drive your investments in support of a comprehensive financial plan?

- If not, would you like to partner with someone who is used to helping people get through these struggles and (then, with confidence) implement portfolio strategies in a systematic manner while focusing on your desired outcomes?

If so, feel free to send us an email or give us a call. We’d love to have the opportunity to help you find a bit more peace of mind when it comes to investing.

Photo credit: Dimensional Fund Advisors

F5 Financial

F5 Financial is a fee-only wealth management firm with a holistic approach to financial planning, personal goals, and behavioral change. Through our F5 Process, we provide insight and tailored strategies that inspire and equip our clients to enjoy a life of significance and financial freedom.

F5 Financial provides fee-only financial planning services to Naperville, Plainfield, Bolingbrook, Aurora, Oswego, Geneva, St. Charles, Wheaton, Glen Ellyn, Lisle, Chicago and the surrounding communities; to McDonough, Henry County, Fayette County, Atlanta and the surrounding communities; to Venice, Sarasota, Fort Myers, Port Charlotte, Cape Coral, Osprey, North Port, and the surrounding communities; and nationally.

We'd love to have the opportunity to hear about your situation. Contact us here to schedule an appointment for a consultation.

Learn more about What We Do.

Helping You With

Wealth Preservation – Wealth Enhancement – Wealth Transfer – Wealth Protection – Charitable Giving