Navigating the Efficient Frontier of Investing

By: F5 Financial

The old saying “Nothing ventured, nothing gained” certainly can apply to investing. If we leave our money under the mattress, it has essentially no risk (other than theft or the mattress catching on fire!), but there is nothing to be gained. Money in the bank is not in our direct possession, but for amounts under $250,000 is insured and considered extremely low risk, yet only gains 0.1 to 0.5% in today’s ultra-low interest rate environment.

When inflation (which is rising) is paired against these paltry gains, you only have a slower bleed on the value of your investment than the mattress strategy, hence not much ventured, and not much gained.

At the other end of the spectrum, if you invest your entire life savings in bitcoin, or a single hot stock of the day like Tesla, you have a chance at tremendous gains—but, along with that, comes tremendous risk and volatility. A huge risk has been taken, which can make or break the reckless investor.

Few returns-minded people are so cautious as to only have all their money in the bank, and few are reckless enough to put all their money into a single risky investment. Understanding the risk in investing and maximizing the returns on this risk involves structuring your investments along what is called “The Efficient Frontier.” We all want to be smart with our money and being efficient in our investing is a big part of that!

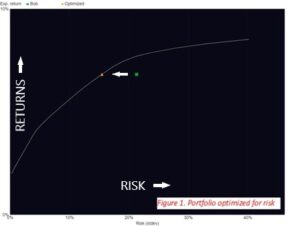

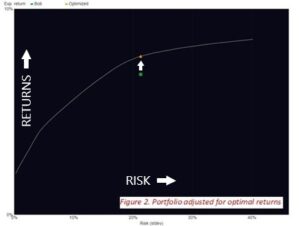

Harry Markowitz, the Nobel Prize winning economist and founder of Modern Portfolio Theory (the paradigm on which most portfolio design is founded on today), believed that there is an optimal investment portfolio that will provide the highest potential returns for a given level of accepted risk to obtain these returns.

- Example: If, with Investment A, you could pay $100 to potentially gain $20 in the next year, but you only risked losing $10, you would likely choose this investment over Investment B—priced the same with same potential gain—but with the risk of losing twice as much ($20)!

- Investment A would be much more efficient than Investment B.

A key concept of the efficient frontier is that diversification increases the amount of reward for a given level of risk. We do not want to put all our eggs in one basket! Let us say you have stocks from twenty companies with the same expected return and risk as the stock of a single company. You will ultimately get a more consistent rate of return with lower risk from the basket of twenty companies vs. the single one, because stocks that underperform or decline in value will be offset by those that perform as expected or exceed expectations. This makes the investment more efficient.

The efficient frontier also shows that adding riskier investments to a portfolio does not mean that you will have proportionally higher returns. In fact, this theory shows that as you add more risk, your returns will continue to increase at marginally lower rates. If you are taking on additional risk, you will want to make sure it is worth it! An efficient portfolio helps maximize gains for the risk taken.

Those that demand higher returns will have to be willing to assume more risk than those that don’t. There is nothing wrong with being an aggressive investor, but understanding your risk and what volatility you are able to withstand to achieve expected gains is important. On the other hand, if you are too conservative, you stand to lose out on significant gains for just a little bit more risk!

Do you know how efficient your investment portfolio is?

A good financial advisor can help you navigate the efficient frontier and manage your investments to help keep them optimized. Understanding your risk tolerance, and the expected returns desired for retirement are keys to streamlining your investment strategy. For a free consultation on how we can help you with this please visit us at www.f5fp.com, or schedule a free consultation.

Would You Like More Support?

- Do you have a well-defined Investment Policy Strategy that is used to drive your investments in support of a comprehensive financial plan?

- If not, would you like to partner with someone who is used to helping people get through these struggles and (then, with confidence) implement portfolio strategies in a systematic manner while focusing on your desired outcomes?

If so, feel free to send us an email or give us a call. We’d love to have the opportunity to help you find a bit more peace of mind when it comes to investing.

Photo credit: rawpixel.com

F5 Financial

F5 Financial is a fee-only wealth management firm with a holistic approach to financial planning, personal goals, and behavioral change. Through our F5 Process, we provide insight and tailored strategies that inspire and equip our clients to enjoy a life of significance and financial freedom.

F5 Financial provides fee-only financial planning services to Naperville, Plainfield, Bolingbrook, Aurora, Oswego, Geneva, St. Charles, Wheaton, Glen Ellyn, Lisle, Chicago and the surrounding communities; to McDonough, Henry County, Fayette County, Atlanta and the surrounding communities; to Venice, Sarasota, Fort Myers, Port Charlotte, Cape Coral, Osprey, North Port, and the surrounding communities; and nationally.

We'd love to have the opportunity to hear about your situation. Contact us here to schedule an appointment for a consultation.

Learn more about What We Do.

Helping You With

Wealth Preservation – Wealth Enhancement – Wealth Transfer – Wealth Protection – Charitable Giving