Watch Out for Tax Torpedoes when Collecting Retirement Income

By: F5 Financial

You have worked hard your whole life to save up the resources needed to retire. As we approach retirement age, it is also easy to retire the thought of paying taxes during retirement, but this can be a big mistake!

Before retirement, predicting tax rates is easy.

As experienced taxpayers, we know that there are marginal income tax brackets that the IRS uses, the tax percentages of which increase as we earn more money, causing us to pay a progressively higher amount of taxes the more that we earn.

These brackets range between 10% for the lowest bracket, to 37% for the highest. During our earned-income years, taxes on this income can be relatively easy to predict, but things can get murky once we retire.

But, after retirement, things can get murky.

Social Security is generally not taxed by itself, but when combined with income from IRA’s or investments, those Social Security payments can get taxed at 50% and then 85% of their value, depending on how much other income you are getting from other sources—a diabolical form of double taxation on a system you have already paid into your whole working career!

Potential tax spikes

IRA’s and other qualified retirement plans are not the only forms of income that can cause Social Security to be taxed. Selling investments and harvesting capital gains for retirement income can also trigger both capital gains tax and a taxable event with Social Security. Another consequence of taking too much income in retirement is increased Medicare Part B Premiums, a “tax spike” if you will.

What is this Tax Torpedo?

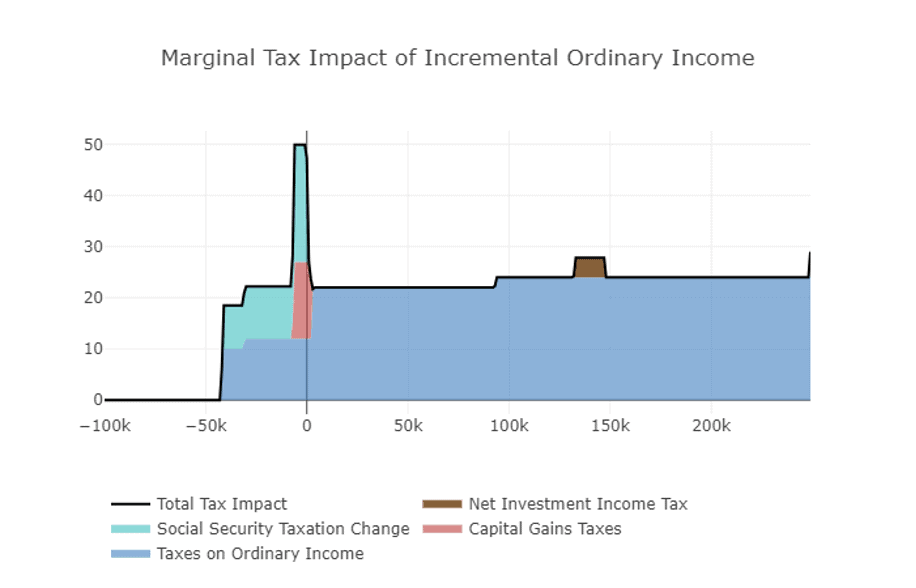

Progressive taxation is alive and well in retirement, but the “tax torpedo” is a special animal that the pre-retiree does not encounter. What is this tax torpedo, and how do you avoid it? This is what happens when social security, IRA withdrawals, and capital gains are all taken at the same time. The tax rates can stack on top of each other for each of these forms of income, rather than just move along an intuitive earned-income marginal tax rate scale like our ordinary wages do.

IRA, Social Security, and capital gains tax rates can “stack.”

Take this example: You have a married couple that has social security and IRA income, and then they sell some stocks and experience a long-term capital gain on the sale of these stocks. It is possible for the tax rates for the IRA, taxable social security, and capital gains to “stack” on top of each other for an effective marginal tax rate of 50% for some of these earnings,

To avoid the Tax Torpedo, be prepared!

Questions to ask yourself are:

- Am I taking income from the right sources, at the right times, to minimize my taxes in retirement?

- Are there any unplanned tax surprises for me in retirement in the coming years?

For more information or support on this topic, please feel free to reach out to us at F5 Financial!

Would You Like More Support?

- Do you have a well-defined Investment Policy Strategy that is used to drive your investments in support of a comprehensive financial plan?

- If not, would you like to partner with someone who is used to helping people get through these struggles and (then, with confidence) implement portfolio strategies in a systematic manner while focusing on your desired outcomes?

If so, feel free to send us an email or give us a call. We’d love to have the opportunity to help you find a bit more peace of mind when it comes to investing.

Photo credit (top to bottom, left to right): Kelly Sikkema (unplash.com), Rawpixel (rawpixel.cxom), and Holistiplan (holistiplan.com)

F5 Financial

F5 Financial is a fee-only wealth management firm with a holistic approach to financial planning, personal goals, and behavioral change. Through our F5 Process, we provide insight and tailored strategies that inspire and equip our clients to enjoy a life of significance and financial freedom.

F5 Financial provides fee-only financial planning services to Naperville, Plainfield, Bolingbrook, Aurora, Oswego, Geneva, St. Charles, Wheaton, Glen Ellyn, Lisle, Chicago and the surrounding communities; to McDonough, Henry County, Fayette County, Atlanta and the surrounding communities; to Venice, Sarasota, Fort Myers, Port Charlotte, Cape Coral, Osprey, North Port, and the surrounding communities; and nationally.

We'd love to have the opportunity to hear about your situation. Contact us here to schedule an appointment for a consultation.

Learn more about What We Do.

Helping You With

Wealth Preservation – Wealth Enhancement – Wealth Transfer – Wealth Protection – Charitable Giving