The Best Solutions Are Simple – Investing in 12 Pictures

By: Curt Stowers

Today we focus on 3 things successful investors do: have a clear goal in mind, develop an elegantly simple strategy, and have the discipline to stay the course.

Back in 2014, Carl Richards at Behavior Gap was gracious enough to share twelve of his best graphics with anyone who wanted them for absolutely no charge. His hope was that financial advisors could take these images and use them to convey the importance of using a disciplined process to reach your investing goals.

I've taken Carl's images and used them to explain how to systematically approach investing based on these twelve pictures. Hopefully, they will help at least one individual take the necessary steps to reach their personal, professional, and financial goals.

Without further ado, picture number three . . .

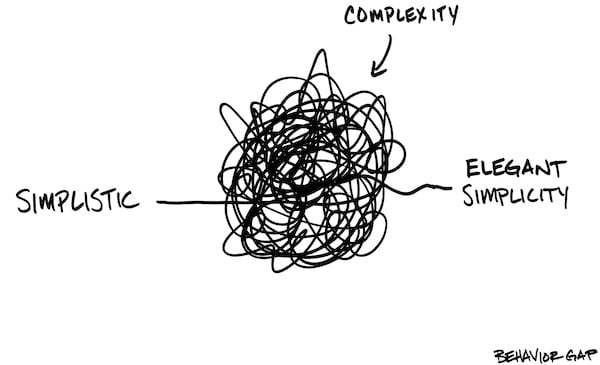

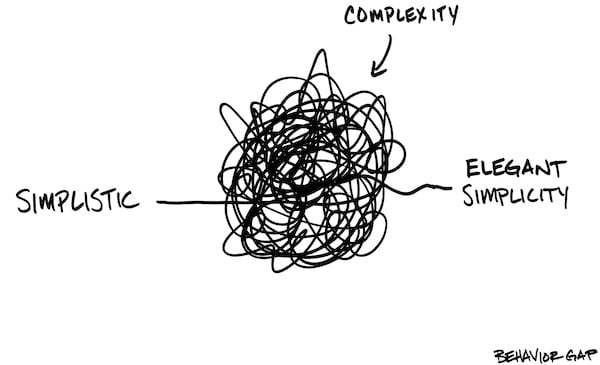

The Best Solutions Are Simple

When it comes to investing, all too many people are confused and fear-struck with the topic. They are convinced that you need to spend countless hours and implement elaborate strategies to be successful in the investing space. Nothing could be further from the truth! Successful investing requires three things:

- Knowledge of where you are going,

- A stable, well-defined strategy

- The discipline to adhere to the strategy

Let's take these in turn:

Investing Step #1: Know where you are going (your goals!)

First, you must have an idea of where you are going. Successful investors realize that they MUST have a goal. While this sounds obvious, it's the most common mistake that investors make. They know they need to be saving, so they start doing so. However, they don't know exactly what they want to accomplish or when they want to accomplish it. Clearly defining your goals is the first step to simplifying the investment process.

Investing Step #2: Have a stable, well-defined strategy.

Second, you must have a stable, well-defined strategy. Many individuals do get past the first step, but then they get stuck in step two. They spend time listening to Cramer, reading the WSJ, talking to colleagues, and chasing the latest fad in the belief that you must be "in the know" to be successful with investing.

Here's a "hot tip" for you—investing is NOT about "hot tips."

They are always looking for the "hot tip" that will bring them success in investing. Here's a "hot tip" for you—investing is NOT about "hot tips." It's about implementing a solid, simple strategy. While each strategy is unique to the individual, all strategies require some key decisions, including:

6 key decisions that every investment strategy require

- The amount of risk you take via your investment in stocks versus bonds

- The diversification of your portfolio via an asset allocation strategy

- Your adherence to a defined strategy via the development and implementation of an Investment Policy Statement

- The placement of your investments in tax-advantaged accounts

- The fees that you pay your advisor

- The fees that you pay the mutual funds you invest

For those readers following along with this entire series of posts, you will recognize that this is EXACTLY the same list that was highlighted in the previous post about focusing on what you can control!

Investing Step #3: Be disciplined and adhere to the strategy.

Finally, we come to the MOST important issue related to investing—self-discipline. Even if you know where you are going AND have a good, stable, well-defined strategy, it is all worthless if you do not have the discipline to stay with the strategy!

Perhaps the biggest—and best—reason to hire a financial advisor is to help you with the topic of discipline. That's right, I'm stating in public that the biggest value often provided by those in my profession is to help people stay the course with their strategy—not because of their financial wizardry, not because they can pick hot stocks, not because they're smarter than you. Rather, it is because a good financial advisor is able to provide you with the discipline that you lack. And that discipline is priceless.

A good financial advisor is able to provide you with the discipline that you lack.

And that discipline is priceless.

Investors are constantly inundated with new messages about "better" alternatives, and, unfortunately, we're programmed to always focus on how to do better—which makes us extremely susceptible to these messages. Furthermore, most investors experience an increased level of fear, both as they age AND as the market goes through its up-and-down gyrations.

Successful investors have a goal, develop a simple strategy, and stay the course.

Successful investors have the discipline—be it self-discipline or through retaining an advisor—to stay the course in spite of the external noises that are constantly assailing their senses.

So, there you have it: have a goal, develop a simple strategy (more on that in a later post), and stay the course. Successful investing is not about picking complex financial vehicles or chasing the latest fad. It's about following these three simple—albeit often challenging—steps.

----------------

Each month, for the next twelve months, I will be publishing another picture to help people understand the investment process.

If you have any questions about the topics covered in this post, feel free to reach out to me at any point in time. At F5 Financial, we enjoy working with entrepreneurs, corporate executives, and families to define their goals and make sure they have plans in place to execute and achieve those goals.

Investing in Twelve Pictures - Previous Posts:

Would You Like More Support?

- Do you have a well-defined Investment Policy Strategy that is used to drive your investments in support of a comprehensive financial plan?

- If not, would you like to partner with someone who is used to helping people get through these struggles and (then, with confidence) implement portfolio strategies in a systematic manner while focusing on your desired outcomes?

If so, feel free to send us an email or give us a call. We’d love to have the opportunity to help you find a bit more peace of mind when it comes to investing.

Illustration credit: Carl Richards (Behavior Gap)

F5 Financial

F5 Financial is a fee-only wealth management firm with a holistic approach to financial planning, personal goals, and behavioral change. Through our F5 Process, we provide insight and tailored strategies that inspire and equip our clients to enjoy a life of significance and financial freedom.

F5 Financial provides fee-only financial planning services to Naperville, Plainfield, Bolingbrook, Aurora, Oswego, Geneva, St. Charles, Wheaton, Glen Ellyn, Lisle, Chicago and the surrounding communities; to McDonough, Henry County, Fayette County, Atlanta and the surrounding communities; to Venice, Sarasota, Fort Myers, Port Charlotte, Cape Coral, Osprey, North Port, and the surrounding communities; and nationally.

We'd love to have the opportunity to hear about your situation. Contact us here to schedule an appointment for a consultation.

Learn more about What We Do.

Helping You With

Wealth Preservation – Wealth Enhancement – Wealth Transfer – Wealth Protection – Charitable Giving